Nepali Tea Exports to US Hit Record $50M, Farmers See Historic Gains

Nepal's tea exports have reached an all-time high with 25,000 metric tons shipped in 2025. These numbers show a remarkable 25% jump from 2022 and have changed the lives of more than 200,000 smallholder farmers and workers throughout the country. The country's dedication to quality and eco-friendly practices stands out clearly. Tea gardens with organic certification now make up 70% of total production, up from 50% in 2022. India used to buy 89% of Nepal's tea exports, but that's changing now. American consumers' preference for eco-friendly and ethically sourced products has pushed U.S. demand up by 40% in 2025. This market expansion has done more than just open new opportunities. Tea garden workers' daily wages have increased by 20%, which has created lasting benefits in Nepal's tea-producing regions.

US Market Embraces Nepali Tea Varieties

Nepali tea exports have soared in the American market, with export value to the US hitting $50 million this year. American consumers now recognize and value the unique character of teas grown in Nepal's high-altitude regions. Tea producers from Nepal are taking advantage of the growing US market that wants premium, ethically-sourced products.

Black Tea in Nepali Tradition Fascinates American Palates

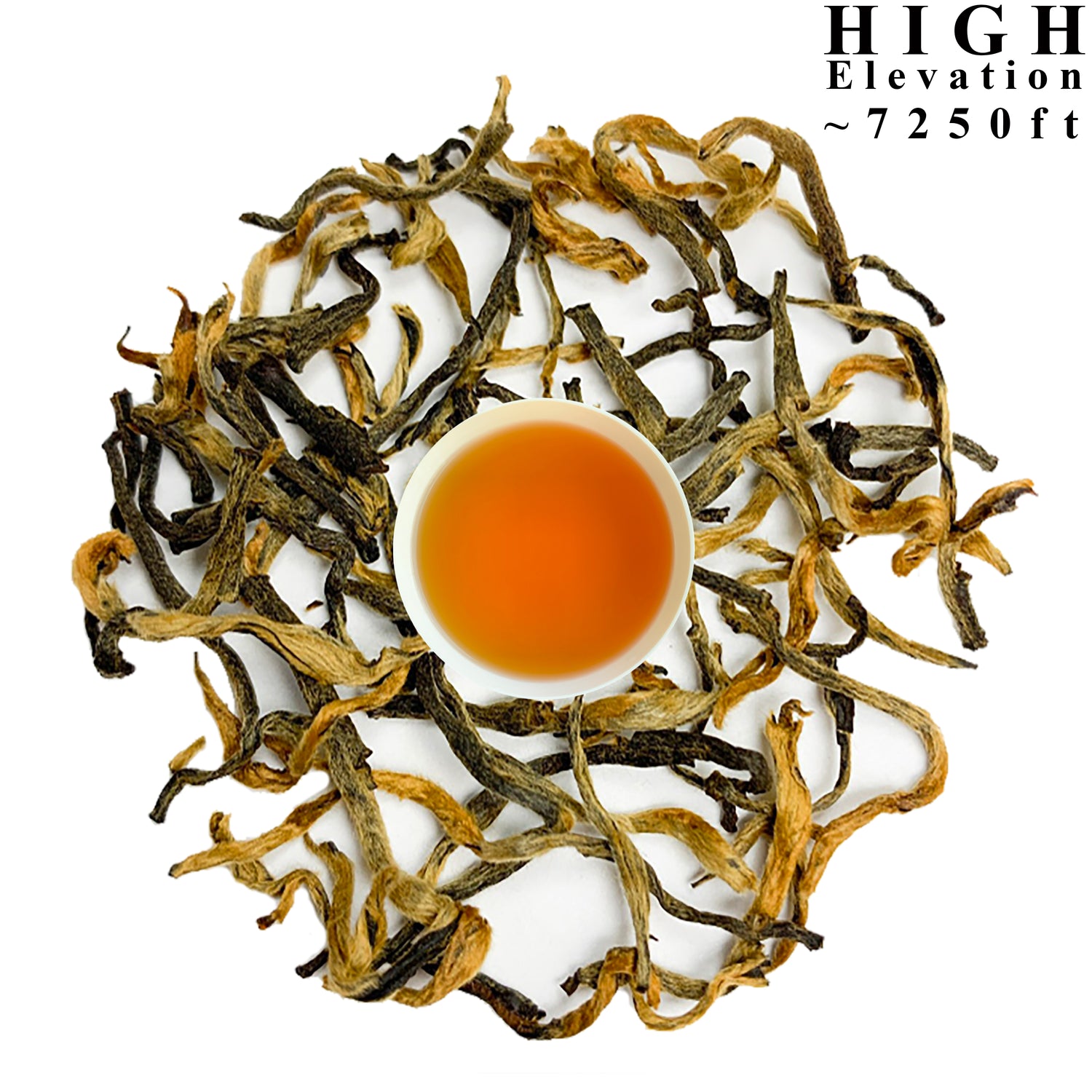

Himalayan black tea varieties lead Nepal's tea export success story. Americans love Nepal's orthodox black teas, which compete with well-known selections from Assam and West Bengal. These teas' robust flavor profiles, with notes of malt, clover honey, and burnt sugar mixed with hints of apricot and clove, have won over US tea enthusiasts.

Sales of premium black teas have surged. The "Himalayan Golden Tea," an award-winning organic black tea from Sandakphu, Nepal, gained momentum after winning the Gold Standard Award at The Leafies International Tea Competition 2024. Nepali Tea Traders' "Kalo Chia" black tea earned third place from the North American Tea Championship, strengthening Nepal's standing among tea experts and professional cuppers.

Orthodox black tea goes through traditional methods like withering, rolling, oxidation, and drying. This creates complex flavors that appeal to Americans looking beyond mass-produced teas. Industry reports show Nepali tea's unit price in international markets has climbed higher than traditional markets like India. US consumers gladly pay premium prices for quality.

Green Tea Exporters Build Distribution Networks

Nepal's green tea has made its mark in US markets. Distribution networks have grown, with Nepali tea now sold in major retail chains including Whole Foods stores across Colorado and specialty tea shops nationwide. This expansion matches Nepal's tea export strategy that targets opportunities in the growing green tea market.

Nepali green tea stands out because of its unique qualities. These teas grow at heights between 4,000 and 8,000 feet. Slower growth at these altitudes creates concentrated flavors and health benefits. USDA-certified organic varieties attract health-conscious American consumers who value sustainable and chemical-free farming methods.

Direct-to-consumer platforms have replaced traditional retail channels. This cuts out middlemen and boosts profit margins for Nepali farmers. Small processors have multiplied thanks to processing equipment from China. This allows for more product variety and market flexibility.

Specialty Varieties Create Premium Market Position

Specialty varieties command higher prices and build brand loyalty. White tea, oolong, and herbal teas from Nepal earn recognition for their exceptional quality. The "Sandakphu Silver White Tea" offers pure, smooth flavors with low astringency and wonderful hints of orange and lemon.

Health benefits drive Americans toward Nepali teas. Research links green tea to weight management, better heart health, and stronger immune response. Health-conscious buyers appreciate Nepal's commitment to organic and sustainable farming.

Nepal's unique growing conditions support premium positioning. Tea experts believe Nepali teas outshine similar varieties because of small production quantities and careful hand-picking methods. Young tea plants growing at high altitudes produce teas with remarkable flavor concentration that justify premium prices.

Nepal's tea industry stands strong against competitors from India, China, and Sri Lanka. The "Nepal Tea" trademark, launched in 2023, helps these teas stand out internationally. This branding success and continued excellence in global competitions sets up Nepal's tea industry for continued growth in America.

Trade Agreements Unlock Historic Export Growth

Trade agreements between Nepal and the United States have opened new doors for Nepali tea producers in the American market. These well-planned arrangements have led to record-breaking export growth. The US now recognizes Nepal as a premium tea supplier. Nepal's export success builds on these vital trade partnerships that have removed many market entry barriers.

How Nepal Secured Favorable US Trade Terms

Two key agreements form the backbone of Nepal's special trade position. The Nepal Trade Preference Program (NTPP), which came into being under the Trade Facilitation and Trade Enforcement Act of 2015, offers Nepal special trade benefits without asking anything in return. This program started to help Nepal rebuild after the devastating 2015 earthquakes. It gives duty-free access to 77 product categories, making Nepal the only country with these unique benefits.

The NTPP coverage has:

- 56 textile-related tariff lines

- 10 leather and footwear tariff lines

- 9 clothing tariff lines

- 2 other manufactured product lines

The seventh Trade and Investment Framework Agreement (TIFA) Council Meeting took place on September 16, 2024, in Kathmandu and made this partnership even stronger. Nepal showed interest in extending and expanding the NTPP beyond December 2025 during this meeting. The United States welcomed Nepal's reform plans but stressed the need for clear regulatory practices to improve trade.

Nepal has made good use of these agreements to boost tea in nepali exports. After joining the WTO in 2003/04, Nepal's tea exports shot up from 884 metric tons to 4,316 metric tons the next year. This growth kept going strong, with Nepal exporting 16,595 metric tons of tea worth NPR 3.94 billion in 2022/23.

Tariff Reductions Drive Competitive Pricing

These agreements give Nepal a huge competitive edge. As an LDC (Least Developed Country), Nepal pays no duties to access US markets and enjoys low average tariff rates of just 5.9%. This special treatment helps nepali tea compete well against products from other countries that pay much higher tariffs.

Nepal's future looks even brighter as global trade tensions rise. Under proposed US reciprocal tariff structures, Nepal would pay only a 10% baseline tariff on exports. Other competitors face much bigger hurdles:

- 34% tariffs on Chinese goods

- 37% on Bangladeshi products

- 26-27% on Indian exports

This tariff advantage has helped Nepal's black tea in nepali tradition and green tea exporters gain more market share. The numbers tell the story – US-bound tea exports grew by 40% in 2025, thanks to consumer demand and these good trade terms.

The benefits go beyond just numbers. Nepali tea sold in China brought in five times more money than in India during 2022-23 and the first ten months of 2023-24. While exact US pricing data remains private, market experts say Western markets show similar premium pricing trends.

Yet some challenges exist. Despite good terms, Nepal's NTPP use has been up and down: exports through this program reached USD 2.37 million in 2017, grew to USD 3.2 million in 2018, dropped to USD 2.47 million in 2020, then bounced back to USD 3.94 million in 2021. Nepal exported goods worth USD 15.15 million through this window in these five years – much less than it could have.

Nepal needs to fix its capacity issues to keep growing. Business owners, especially those in tea leaves in nepali growing regions, need better technical skills right away. Getting the NTPP extended beyond December 2025 is crucial. Trade officials want these benefits to continue for at least ten more years to help Nepal handle changes after it moves up from least developed country status.

Nepal has created a detailed tea export plan that includes testing a tea auction house to get better prices and reach more markets. This plan, along with current trade benefits, puts nepali tea in a great position for continued growth in the American market.

Tea Production Scales to Meet Surging Demand

Nepal's tea industry has scaled up its production to meet the rising international demand. The annual exports reached Rs 3.8 billion in fiscal year 2078-79 BS. Local producers added another Rs 140 million the following year by making smart business moves to grab unprecedented market opportunities.

Ilam Region Doubles Processing Capacity

The Ilam district stands as the life-blood of Nepal's orthodox tea production. The region's manufacturing base has grown remarkably. Local infrastructure now includes 24 large-scale and 60 small-scale tea factories. Nine more facilities are under construction. This growth has created many jobs throughout the district. Tea cultivation now covers 7,965 hectares.

Small farmers own 5,120 hectares and produce 2,715 metric tons yearly. Estates manage 2,845 hectares with a yield of 2,170 metric tons. The Danish government's Unnati program has played a vital role in this expansion. The Ministry of Agricultural Development implemented it with Rs 350 million in funding, while farmers contributed Rs 280 million.

The production capacity has grown, but challenges remain significant. Ilam's factories process about 15,000 kg of green tea leaves daily. This number jumps to 100,000 kg during peak season. The rapid growth in factory numbers compared to cultivation has created leaf shortages. Raw leaf exports to India have made this situation worse.

Technology Investments Boost Quality Control

The tea sector has reshaped the scene through major investments in manufacturing technology. Small-scale producers now use Chinese equipment like withering troughs, rotor flying pans, tea rollers, and dryers. These machines help create black tea, pan-fried green tea, and specialty varieties. Smaller operations can now offer diverse products without spending as much as traditional large facilities.

Quality assurance programs are the foundations of Nepal's export strategy. Accord India International Pvt Ltd manages nine factories in Ilam and has set up complete quality systems. These systems meet European Union and Japanese standards. Many facilities now seek Rainforest Alliance certification along with Good Manufacturing Practices and ISO 22000 protocols.

The National Tea and Coffee Development Board leads quality standard implementation. It monitors production and promotes collective trademarks. Past initiatives like the Himalayan Tea Technology Expansion Program (Himtex) and TeaShake project showed limited success. The current investments have proven more effective at improving production capabilities.

Organic Certification Processes Streamlined

Premium international markets, especially in the United States, value organic certification highly. Quality Management System Nepal Pvt. Ltd (QMS Nepal) has government authorization to certify products. They work with international standards including USDA, EU, JAS, PROCERT UK and Bio Suisse.

The certification process used to cost $7,000-10,000 for the first year and $5,000-6,000 yearly after that. The process runs more efficiently now. Nepali tea gardens with certification have increased from 50% in 2022 to 70% today. Eight cooperative processors hold certifications—two for processing facilities and six for tea gardens as raw material suppliers.

These certifications offer clear benefits:

-

Better prices (certified tea sells for NRs. 70.74/kg versus NRs. 41.87/kg for non-certified leaves)

-

Higher profits (NRs. 24.21/kg compared to NRs. 14.21/kg for non-certified products)

-

Guaranteed sales through contracts with certified tea processing factories

The numbers tell a compelling story. The B/C ratio for certified orthodox tea hits 1.8 in prime locations like Ilam Municipality. This creates strong incentives for farmers to get certified despite upfront costs. International buyers just need verified organic products more than ever. These efficient certification processes help maintain Nepal's export growth.

American Retailers Transform Nepali Tea Marketing

American businesses have created state-of-the-art marketing approaches that present Nepali tea as a premium, high-value product. These creative strategies help build distinct brand identities that command higher prices in the competitive US beverage market. They also create stronger bonds between American consumers and Nepali tea farmers.

Luxury Brands Feature Tea Leaves in Nepali Packaging

Nepal's teas have gained a premium spot in American retail through authentic packaging and compelling origin stories. Nepal Tea Collective shows this perfectly with their limited-edition Rose Label Reserve, a luxury black tea that sells for $100 per 100 grams. This exceptional black tea in nepali tradition comes in handcrafted packaging that tells its royal story—a tea once gifted to a Nepali king and now grown in eastern Nepal's gardens.

Luxury retailers tell stories about tea leaves in nepali regions, especially when you have Ilam, where high-altitude farms (4,000-8,000 feet) produce teas with "vibrant character and unmatched freshness". Their marketing materials highlight how these leaves are:

-

Made as single-origin teas by small, green farms

-

Pure without additives and pesticides

-

Picked by hand with careful methods

-

Grown at heights that boost flavor complexity

The packaging uses traditional Nepali design elements to create an authentic look that appeals to luxury consumers who want quality and cultural connection.

Direct-to-Consumer Platforms Eliminate Middlemen

Many American retailers now have direct relationships with Nepali farmers. This has reshaped the economic model of tea in nepali trade. Nepali Tea Traders became the first US company to sell only premium teas from Nepal's Ilam region. They live by "From Farm to Cup," which ensures farmers get fair prices and profit shares.

Young Mountain Tea goes beyond basic sourcing—they build farmer-owned production facilities. Their Kumaon Tea project helps farmers earn five times normal rates and get extra income through shared ownership in processing facilities.

These direct partnerships benefit both sides:

American tea lovers get fresher products with clear sourcing. Nepali farmers earn more money to "support their families, improve their farms, and provide education for their children".

Social Media Campaigns Highlight Himalayan Origin

Social-first marketing strategies work exceptionally well to promote nepali tea varieties. Social media campaigns showcase the unique Himalayan origins, and the content highlights environmental and social benefits.

Beyond regular marketing, retailers create content about brewing methods and tea varieties. This helps distinguish Nepalese teas from others and supports premium pricing. Danfe Tea openly talks about how Nepali teas were "overlooked, mislabeled as Darjeeling tea of India, and often overshadowed".

The stories connect tea drinkers directly with farmers. Nepal Tea Collective's social platforms show farmer profiles and harvest updates. Their taglines—"SIP the highest quality organic single-origin teas, TIP the farmers who made your tea, RIP the outdated and exploitative tea trade"—capture their mission-driven marketing approach.

These marketing innovations have boosted Nepal's tea export success by a lot. They've created premium product positioning, cut out unnecessary middlemen, and built real connections between American consumers and Nepali tea producers. This approach has made Nepali tea stand out as a valued category in America's competitive specialty beverage market.

Export Revenue Creates Economic Ripple Effects

Nepali tea exports bring in foreign currency that has changed the economic landscape of rural farming communities. Tea exports worth Rs 3 billion annually generate revenue that stimulates development way beyond the reach and influence of tea-growing regions.

Rural Infrastructure Development Accelerates

Revenue from exports has funded major upgrades to transportation networks in tea-producing regions. Better roads help distribution systems deliver fresher tea leaves in nepali growing areas to international markets at peak quality. These upgrades make a real difference in farming communities where tea makes up over 60% of household income.

The improvements go beyond just transportation. Tea production has grown significantly in regions like Ilam, leading to better electricity distribution. Processing facilities now run more efficiently during harvest season. This reliable infrastructure attracts new processors to set up operations in areas that were previously underserved.

Tax revenue from tea exports flows directly into community development projects through local government initiatives. These projects have helped tea-producing regions keep their young workforce from moving to cities.

Banking Access Expands in Tea-Growing Regions

Banks have set up branches across tea in nepali growing communities. They now operate in 752 out of Nepal's 753 local government jurisdictions, which has transformed rural economies. Farmers can now access formal financial services that were once out of reach.

Nepal Rastra Bank and the United Nations Capital Development Fund have created strategic collaborations to support agriculture value chains, including orthodox black tea in nepali production. These programs are a great way to get financial products that meet smallholder farmers' specific needs.

Before these programs started, only 26% of Nepalese households had bank accounts, as banks operated mainly in urban areas. A mere 5% of tea farmers could get loans to grow their businesses. Today, banks offer specialized agricultural credit programs that help farmers invest in quality improvements to earn premium prices internationally.

Mobile banking services have become especially valuable in remote areas. Farmers can now handle their transactions without traveling far to visit physical bank branches.

Competitors Respond to Nepal's Market Gains

Nepal's tea market success has sparked quick reactions from long-standing tea producers in Asia. Traditional industry leaders now adjust their strategies to keep their market positions as Nepal's influence grows.

Indian Producers Adjust Pricing Strategies

Indian tea exporters have changed their pricing to respond to Nepal's tea growth. Their exports jumped 10% to 255 million kg in 2024, and the export value climbed over 15% year-on-year to Rs 7,111 crore. Industry experts now acknowledge that Nepalese teas cost 35%-50% less than Darjeeling teas and have entered traditional Indian export markets. This price gap creates challenges for Indian producers, especially in premium segments where Darjeeling tea sales struggle.

Darjeeling planters worry that domestic buyers choose Nepal teas sold as Darjeeling products. Darjeeling's production dropped from 11 million kg to 6.6 million kg in 2022. Indian producers responded by setting stricter pesticide residue standards in 2025, which led to several rejected Nepali tea shipments.

Chinese Oolong Tea in Nepali Markets Faces New Competition

The U.S.-China trade dispute has opened doors for Nepal's oolong tea production. Chinese tea exports to the U.S. now face higher tariffs after 2024 escalations, and Nepali producers have seized this opportunity. American buyers love Nepali teas for their unique flavors and environmental responsibility.

Sri Lankan Exporters Seek Similar US Partnerships

Sri Lanka stands as the world's third-largest tea exporter and works harder to build stronger U.S. partnerships. They hold just 3% of the U.S. tea market despite their global ranking, which shows room for growth.

Ambassador Wickramasuriya has asked Sri Lankan tea producers to target the U.S. market more actively. The Sri Lankan Embassy now helps tea traders through better cooperation with the U.S. Tea Industry, seeing "immense opportunities" in this growing relationship.

Conclusion

Nepal's tea industry has come a long way in the last decade. American consumers have embraced Nepali tea's exceptional quality, as shown by reaching the $50M export milestone. This success comes from our focus on organic certification, with all but one of these gardens now certified. The unique high-altitude growing conditions create distinct flavor profiles that set our teas apart.

The benefits reach well beyond just export numbers. Smallholder farmers now earn 20% more, while their communities enjoy better infrastructure and banking services. The Nepal Trade Preference Program with the United States is a vital advantage that reduces tariffs significantly. These benefits, plus modernized processing facilities, help Nepal compete effectively against established tea-producing nations.

Quality-focused American retailers have raised Nepali tea's profile through premium positioning and direct-to-consumer sales. Tea lovers who want authentic, ethically sourced products can now buy our finest orthodox teas through trusted sellers like danfe.com. They offer carefully selected teas from Nepal's best growing regions.

The future looks bright for Nepal's tea sector. Our investments in production capacity, simpler organic certification, and fresh marketing approaches build strong foundations for growth. While competitors may change tactics, Nepal's perfect growing conditions, skilled farmers, and traditional production methods give us a unique place in global markets.

FAQs

Q1. What factors have contributed to the recent success of Nepali tea exports to the US?

Several factors have driven the success of Nepali tea in the US market, including the growing demand for organic and sustainably sourced products, unique flavor profiles due to high-altitude cultivation, favorable trade agreements reducing tariffs, and innovative marketing strategies by American retailers highlighting the tea's Himalayan origin.

Q2. How has the increase in tea exports impacted Nepali farmers and rural communities?

The growth in tea exports has led to significant benefits for Nepali farmers and rural areas. Farmers are seeing 20% higher wages, while rural communities are experiencing improved infrastructure development and increased access to banking services. This economic boost has helped retain younger workers in tea-producing regions.

Q3. What types of Nepali tea are most popular among American consumers?

American consumers have shown particular interest in Nepal's orthodox black teas, green teas, and specialty varieties like white and oolong teas. These teas are valued for their unique flavor profiles, health benefits, and the story behind their production in the Himalayan region.

Q4. How are Nepali tea producers ensuring quality and meeting international standards?

Nepali tea producers have invested in technology to enhance quality control, with many facilities implementing comprehensive quality systems meeting European Union and Japanese standards. Additionally, there's been a significant increase in organic certification, with 70% of Nepali tea gardens now certified organic, up from 50% in 2022.

Q5. What challenges does the Nepali tea industry face in maintaining its growth in the US market?

While experiencing success, the Nepali tea industry faces challenges such as competition from established tea-producing nations, the need to continually improve production capacity and quality, and the importance of maintaining favorable trade agreements. Ensuring consistent supply and adapting to changing consumer preferences will be crucial for sustained growth.